CAPRAL - Aluminium Price Increases

News & Events > CAPRAL – Aluminium Price Increases

News & Events > CAPRAL – Aluminium Price Increases

Regional premium (Asia/Pacific region benchmark is the Major Japanese Ports or ‘MJP’).

Base billet (product) premium, which includes the additional costs incurred to produce billet.

Surcharges for freight, alloy, diameter may also apply.

Total Billet Price = LME + MJP premium + Base billet premium + Surcharges

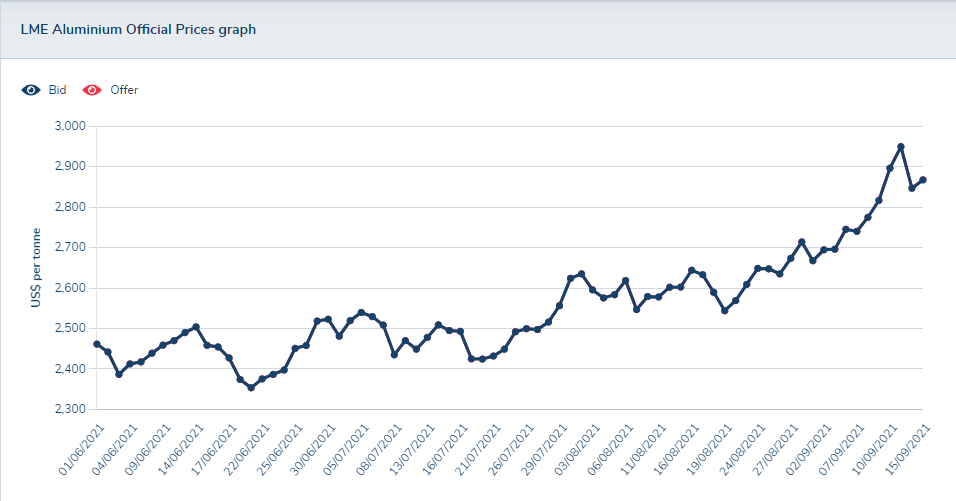

LME prices are adjusted monthly, MJP premiums are adjusted quarterly, and Base billet premiums and surcharges are adjusted annually.

Base billet premiums

Over the past decade base billet premiums have been stable due to a reasonable supply/demand balance for billet. The situation has changed dramatically for 2022. Global demand for billet in 2022 has outstripped supply and has led to up to 350% increases in premiums for 2022 smelter supply contracts.

Click to download the letter from Capral’s main supplier, Rio Tinto, which outlines the key drivers for the current escalation in LME and 2022 premiums.

The significant increase in smelter base billet premiums for 2022, together with other inflationary cost pressures, unfortunately, leaves Capral no option but to increase its price spreads. Therefore, effective 1st February 2022, Capral will be increasing all base spreads. We are currently finalising contracts and assessing the impact of the higher LME and premiums on net scrap costs. These will be confirmed within the next two weeks, but we anticipate spreads to increase between $0.40kg – $0.55kg.

WHAT ELSE?

Find more information on international price increase regarding the low Magnesium availability Read more here

Like what you read? Keep up to date with the Metrix Group Newsletter.